Mobile App Development, SEO, Social Media, Web Development

4 Ways to Create Compelling Value for Your Clients

- By Brett Belau

04 Feb

The Four Client Value Drivers

The rubber hits the road for a consultancy, heck, for any company, when the time comes to prove that value has been created for its clients and customers.

Understanding the concept of value creation is essential for effective monthly reporting, client retention, and up-selling additional work.

But it merits unpacking what “creating value” actually means for clients. How can we even define “client value”?

Well, it turns out that client value comes in several flavors. Understanding each can prove invaluable in understanding, in turn, how to make yourself indispensable to your clients. The key is to align your services and know-how to critical (and often not-so-obvious) aspects of your clients’ business.

There are four basic ways to create value for clients, and they boil down to delivering products and services that help them:

- Generate More Revenue

- Save Money / Reduce Cost

- Avoid A Planned Future Cost

- Insure Against Future Loss

*Bonus: There is actually a fifth way to create value for clients: Increase Optionality. I won’t dig into that here, but so-called “real options” (as distinct from, but similar to, financial options) is an interesting area of study unto itself. With “real”, or “managerial” options, essentially there is calculable value in simply having the choice between two or more strategic paths. (This might be a fun post for another day:-)

Site Traffic Doesn’t Pay the Rent

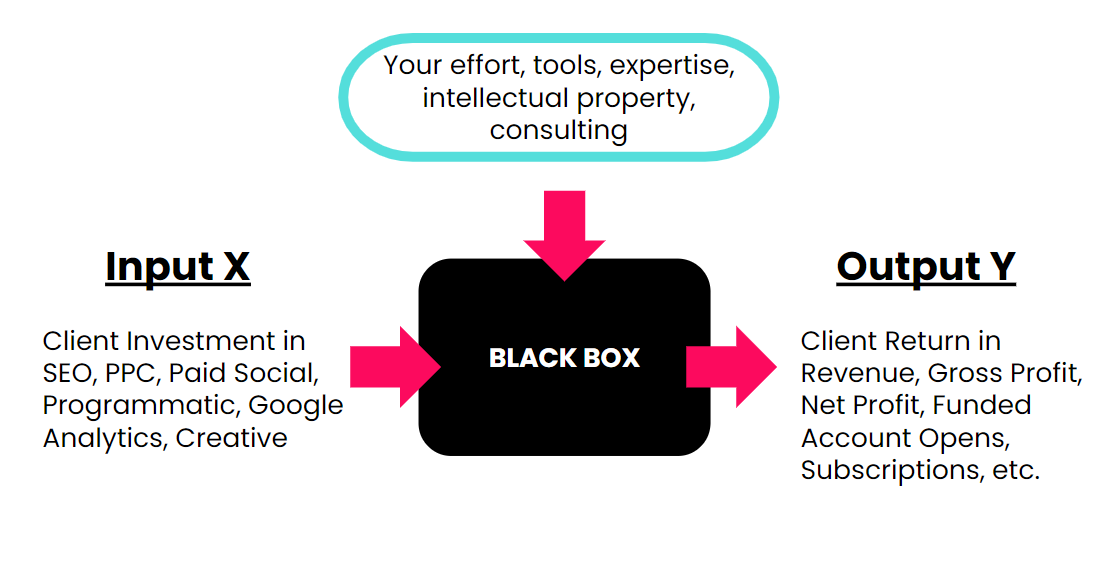

To help motivate a discussion on the four ways to create value for your clients, I like to imagine that behind every Director or VP of Marketing lurks a Director or VP of Finance that thinks of her company’s investment in SEO, PPC, Paid Social, really, anything, as a “black box”.

Financial Inputs go into the black box (agency fees, internal labor cost, ad spend, and the like) and financial Outputs come out (channel revenue, Gross Profit, Contribution Margin, Net Margin, etc.).

It’s critical to think of these Inputs and Outputs in terms of dollars — to that VP of Finance, site traffic doesn’t pay the rent.

To that VP of Finance (who, by the way, maybe in the chain of approval for your Statement of Work, whether you realize it or not), what’s in the black box doesn’t matter!

It can be your agency fees and ad spend or opening 10 more retail locations. Cash Inputs go in, and Cash Outputs come out.

So, investment dollars go into the black box, stuff happens inside the box, and a stream of cash flows out:

Image: The client’s investments as a “Black Box”

You can also think of the Output as potentially increasing the wealth of your client. Literally if your digital campaign is a winner, your client’s bank balance, or wealth, should increase.

Yes, oh math-inclined reader, you can think of the Black Box as a function that maps inputs to outputs by Y = f ( X ) and this will prove handy in a moment.

Talking CTRs & SERP Features with Finance

Ever wonk out about CTRs, BERT, SERP features, or page load speeds with a Director of Finance during a pitch for budget, and her eyes glaze over? Ever wonder what she’s thinking? It will be a variation on:

- Yeah, yeah, yeah. How much investment do you want from me?

- What cash flow will I receive for that investment?

- How long will that cash flow last?

- How lumpy will those cash flows be?

- What is the chance that no cash flow shows up at all?

- Can I get those same cash flows for a lower investment from someone else?

If you’ve sold consulting services for a while, you know that eventually, all roads at the Client lead to someone who asks those questions, or to someone who has to go to a VP of Finance and answer them on your behalf.

Creating value for clients is rooted in helping your Client Point of Contact (POC) or Senior Decision Maker translate what you do (or hope to do) into answers to those questions.

Financial Assumptions for Creating Value

OK, let’s dig in! And to get things rolling, let’s make some related theoretical assumptions that, for the purposes of this post, we’ll take as given:

Assumption #1 – For clients, having more cash is better than less cash, but the incremental benefit decreases with the more cash the client has.

Assumption #2 – At any level of wealth greater than zero, gaining more cash is not as sweet a feeling as losing that same amount of cash is painful.

Assumption #3 – Cash that arrives with metronome consistency, and without fail, is valued more highly by clients than cash that shows up randomly, or not at all.

In short, we’re assuming that our clients are risk averse and this concept is key to understanding how your work can create value for them, so we’ll tackle each one in turn.

More cash is better than less cash, but the benefit decreases

Ever hear of “the law of diminishing returns”? Well, this is it and the concept is simple. Suppose you’ve been going hard playing basketball: fast breaks, dunks, blocked shots, the works. In August. Outside. In Miami, FL. In the middle of the afternoon. You’d be pretty thirsty right? Sure! Someone offers you a tall glass of cold water and you gulp it down. Refreshing!

They offer you a second. And then a third. You’re not as thirsty as when you first stepped off the court, but you drink them.

Then you’re offered a fourth, and you hold your hand up, “No thanks, I’m good!” This is the “law” in action!

That first glass of water gave you a lot of refreshment or “utility”. The second glass was a winner too, but maybe not to the same degree. By the fourth glass you didn’t want any more: the additional refreshment or utility from drinking yet another glass of water was approaching zero, so you said no thanks.

You can show this relationship graphically like this:

Image: Diminishing marginal utility

It turns out that money can work the same way. If you launched a business, the very first $1,000 you receive from a client and put in the bank is going to feel really, really good. But when you’re Apple sitting on $13.8 billion in cash, that next $1,000 won’t get Tim Cook off the couch.

This concept is called the “diminishing marginal utility of wealth”, and you can see it in the above chart. In the move from X1 to X2 the increase in utility (i.e. benefit from getting X) is greater than the increase in utility going from X2 to X3. This relationship is due to the shape of the “Utility Curve” drawn in the chart. There are many different ways to draw a utility curve, but it turns out that the one shown explains a lot of human behavior.

The key takeaway here is that at every point of this curve, as you add more X, more money, glasses of water, or Porsches, utility does indeed go up. But, it goes up by a lesser amount with the more X you add.

Now, while you yawn and shake the cobwebs off your Econ 101 notes, consider that, for the most part, the $603 billion US insurance industry is built on this simple concept. How?

Losing money hurts more than gaining money feels sweet

Let’s consider that Utility of Wealth graph again.

Image: Utility of Wealth Curve

Starting from the amount of wealth W, note that as you add the amount of wealth x, Utility goes up by amount a. But, if you remove the amount of wealth x from W, Utility drops by a greater amount, b. Given the shape of this utility curve, note that b > a for all levels of wealth W > 0.

Irregular cash flows are less valuable than stable, regular cash flows.

You can think of this as an application of the Utility of Wealth conversation above.

Suppose some amount of cash showed up on the 1st of every month. Maybe it’s your paycheck, P and it is normally $100. Consider Scenario 1, where the chance your check shows up is 100%. That is, each month you absolutely get paid. Sweet!

Now imagine Scenario 2 where in any given month, there is a 50% chance that you get $50 and a 50% chance that you get $150. This is what you face:

50% chance you get $50.

50% chance you get $150

So, your expected pay, in any given month, is $100, equal to your Scenario 1 guaranteed monthly pay. How?

Expected Pay = E [P] = (50% x $50) + (50% x $150) = $100

Another way to think about it is that over many months, the average amount of P you get each month is indeed $100. Some months you get $50 and others you get $150, but you average $100.

So, with Expected Pay, E [P], = $100 shouldn’t you be just as happy (i.e. get just as much “utility”) in Scenario 2 as getting your guaranteed P = $100 in Scenario 1? Well, let’s take a look at that on the Utility of Wealth graph!

Image: Expected Utility of Wealth Curve – Scenario 1

Here’s what’s happening: 50% of the time, you get $150, and enjoy UP=150 and the “extra” enjoyment you get over the Expected Pay is the amount of a. But 50% of the time, you only get $50, and the loss of enjoyment you realize is the amount b. Remember from above, b > a. So although the expected value of the cash payments you get each month is the same as your guaranteed amount, $100, the expected utility you realize is LESS than that of your guaranteed amount.

E [ U ] = (50% x UP=50) + (50% x UP=150)

(Because we are assuming that you’re risk averse, mathematically it can be shown that Expected Utility, E [ U ], is less than UP=100 the level of utility from the guaranteed pay of $100.)

Image: Expected Utility of Wealth Curve – Scenario 2

Ouch!

But here is the kicker: in Scenario 2 you’re not actually receiving $100 each and every month. It’s average. Some months you get $150, and some months you only get $50. In practice, there can be some real pain here — you can’t plan your budget. You can’t buy a house as there will be months when you may not be able to cover the mortgage!

How would you survive? In months where you get $150, you’d sock money away to cover the months of half pay. This works but it adds stress and complexity. Plus, since these are probabilities, there is a chance you go 6 months in a row receiving only half pay. You may have to move back in with your parents!

Might you be happy to pay some amount of money each month to avoid dealing with Scenario 2 altogether? Absolutely you would! It’s called insurance.

Insurance is a mechanism to make lumpy cash flows more consistent

Let’s take another look at the Utility of the Wealth Curve.

Image: Utility of Wealth with Insurance

The key is to start by looking at the Expected Utility, E[U] again. If you can be guaranteed the Expected Utility, E[U], from Scenario 2 each month, but without having to risk dealing with $50 paychecks, you’d be willing to pay up to some amount Y. Y, therefore, is the insurance premium and is the most that you’d be willing to pay someone to NOT face Scenario 2 each month.

In practice, you’d agree to take the insurance and somebody else worries about the risk of you receiving $50. You’re guaranteed to receive the Expected Utility E[U], less the monthly insurance premium, Y.

(In this particular example, if you got $150 one month, great! If instead you only received $50, you’d tell the insurance provider and they would Venmo you $50 to get you up to $100, your expected payment, P. In return, you just have to pay the insurance premium Y each month)

OK, now you’re saying, “WHAT THE @$%#$! DOES THIS HAVE TO DO WITH DIGITAL MARKETING?” Read on, read on!

Mapping Your Work To Client Value Drivers

With these concepts under our belts, now we can dig into how to create value for your clients and speak the VP of Finance’s language to show how you’re going to do it.

Method #1 – Generate More Revenue

This one is straightforward. Because of your direct actions, ingenuity, tools, and processes, you help your clients sell more widgets. The client gets more revenue output Y for the same investment input X with you and your agency vs. that same investment X in another agency.

Ideally, though, the focus is on Gross Profit or cash flow, not (or perhaps not just) the revenue. Why?

Because your fees are paid for out of the Gross Profit. It’s possible that the increased revenues you bring come with a greater CPA or lower ROAS or ROI. If your POC is focused on revenue but the VP of Finance is looking at profitability, you’re going to have a problem.

Also, remember the concept of diminishing marginal utility of wealth. You may show the VP of Finance a path to making an incremental $100K in profit only to discover that, given your client’s size or aspirations, $100K isn’t enough to help them reach their goals. Juice < Squeeze.

[TIP]

At the end of the day, Gross Profit pays the rent, NOT Revenue.

Bottom line: You create value for your clients by increasing their wealth. In this scenario, you achieve that by increasing revenue and Gross Profits, or perhaps Gross Profit Margin. Make sure what you show our POC (and the VP of Finance lurking behind her) can have a meaningful impact on their business.

Method #2 – Save Cost

Also straightforward, here by your direct actions, ingenuity, processes, and tools you eliminate waste, increase efficiency, or halt actions or activities that cost your client money. Maybe you can perform services more cheaply than your client can internally, and they engage you to do it. Maybe you license a process to your client that allows them to execute a task more efficiently, reducing per-unit costs.

In the PPC context imagine negating irrelevant search terms that do not yield conversions. Or, recommending a 3rd party landing page platform for a client allowing them to stop paying a more expensive creative team to build landing pages from scratch.

Sometimes providing Technical SEO services can save the client money by allowing them to redeploy expensive internal resources to other priority tasks.

The diminishing marginal utility of wealth holds here too. How does saving a client money increase their wealth? In the same way that cutting personal expenses can increase your bank balance. Similarly, make sure that any savings you show can be quantified.

[TIP]

There are a couple of ways to describe the impact of cash savings. One is that it’s a benefit on its face — If you save your client $100, then she is $100 wealthier by definition, all else being equal. But, let’s say your client has 33% Gross Profit Margins. That $100 in cost savings represents $300 in revenue not needed to hit the same Gross Profit goal. So, cash savings can take a little pressure off a sales team too;-) Let’s call that one “client internal politics” value!

Bottom Line: Saving costs also tends to increase the wealth of your client by increasing cash flow with the same level of revenue. Make sure the amount of cost savings can have a meaningful impact on their business.

Method #3 – Avoid Future Costs

Now things get interesting. This value creator, also called “cost avoidance”, involves taking deliberate steps today to avoid a known future additional or planned cost that would otherwise be incurred if no changes were made.

For example, suppose you were advising an SEO client who had an m.dot mobile site and a separate dot.com for desktop users. The client wants to refresh the design of both sites and migrate both sites to a new CMS, but keep the mobile and desktop sites separate. In the current plan, the client would have to engage a 3rd party development team as well as hire a project manager to maintain both versions of the website and make sure content deployed on one site shows up appropriately on the other.

Now suppose that you recommend that the client instead migrates both sites to a single, fully responsive site on the new CMS. If they were to do so, their existing webdev team could handle site maintenance without the need for the 3rd party dev team, and they wouldn’t need the project manager.

The client hadn’t incurred the cost of the 3rd party dev team or the project manager yet, so their current P&L doesn’t change. But you did help them avoid an additional future cash outlay. That’s value!

Cost avoidance can be hard to quantify exactly because it’s difficult to 100% prove a counterfactual situation. Yes, the 3rd party dev team and the project manager were budgeted with estimated costs, but if the client never takes that path, it will be impossible to know for certain, post hoc, how much money was truly saved via the responsive site. It is valuable nonetheless. Why?

Because if the client has a budget that shows the cost of the dev shop and project manager, they can now remove them, thereby increasing future cash flows.

Imagine you have a car that needs a $1200 new transmission and you planned to take it to the shop next month and get it fixed. This weekend you see a promotion for a new car and decide to trade your old one in. You would thereby avoid the future cost of that transmission. And who knows? If you took the car to the shop as planned the mechanic may have found other problems to be fixed costing you more. But what is known with certainty is that you can use that $1200 instead for a trip to Paris!

Our old friend the marginal utility of wealth applies here too! Why? Avoiding a future cost, with a benefit dependent on how far in the future it would occur, increases your clients’ wealth today via the concept of Present Value.

[TIP]

In my experience, Cost Avoidance is often overlooked when consultants describe the value they create for clients. New revenue and cost savings are straightforward and easy to calculate. Cost Avoidance is harder to calculate for billing purposes, say, but no less meaningful as a benefit to clients.

Bottom Line: Cost Avoidance increases your client’s future (and present) wealth by obviating the need for future expenditures.

Method #4 – Provide Insurance

As we have established, people (and clients) tend to be risk averse: they tend to experience greater pain from a loss than joy from gain. As a car owner, I’m willing to give up some wealth (in the form of a monthly insurance premium) to avoid the risk of being left with nothing in the event of an accident. Setting the deductible and statutory requirements aside for the moment, if I get in an accident I’m made whole. I effectively pay an insurance premium to avoid “the gamble” inherent in driving.

I can assure you that your clients intuitively understand this but in a different context. Most companies carry insurance as well: General Liability Insurance, Umbrella Coverage, Data Security Insurance, Loss of Income Insurance, Workers Compensation Insurance, etc.

The trick is that many clients do not immediately think of insurance in the marketing context.

Consider a large eComm client with an internal PPC team. Typically this team is self-sufficient, and that’s the point: they fired their agency in the past and stood up an internal team. But for their eight-week busy season, the client engages an experienced PPC agency on a short-term retainer. This agency provides on-the-spot guidance to the internal team and can take on overflow campaign management if need be. The SOW that covers this eight weeks worth of work is an insurance policy.

Depending on the level of ad spend and the senior decision maker’s degree of concern regarding her internal team’s abilities and the revenue potential involved, she might spend a fair amount of money on a temporary agency retainer. (Remember, she’s likely risk-averse with a utility curve shaped like the one above!)

So, how much is she willing to spend for insurance? Theoretically up to some number Y, as we showed above, that leaves her just as happy to pay the premium as taking the expected value of the gamble. The eComm context is interesting because of the importance of the “busy season” — some sites make up to 80% of their annual revenue on Black Friday alone — so the desire to maximize revenue capture opportunity is high.

Time for some cringe-worthy back-of-the-napkin math!

Suppose the decision maker thinks she can make $1MM in Gross Profit if her team absolutely kills it and only $500K if they do not. She guesses there is a 70% chance of the $1MM and a 30% chance of the $500K. The expected value is $850K

Since we’re making stuff up, suppose her Utility of Wealth can be defined by U = ln ( Wealth ), for all Wealth levels > 0. Remember Natural Logs?!

The graph is below, and here are the results:

Expected Value of Wealth (i.e. Gross Profit) = E [ W ] = $850,000

Utility of E [ W ] = 13.65

Expected Utility [ W5, W10 ] = 13.45

“Certainty Equivalent” wealth level at the Expected Utility = $697,000 ( given by Wealth = e( 13.45 ) )

Amount of Risk Premium (i.e. “Insurance Premium”) = $153,000

Image: eComm Client Utility of Wealth

This means that, given the raft of assumptions being made, in theory, the decision maker facing this gamble would be willing to pay up to $153,000 for an “insurance SOW” to avoid the gamble of her internal team botching the eight-week busy season.

In reality, a client is likely not facing a gamble on Gross Profit this extreme across their busy season, but the point is that you can prepare for a negotiation armed with a few numbers and your client’s answers to a few specific questions.

[TIP]

Ever have a client that dropped you right after their busy season ended? Well, they wanted to fire you before the busy season, but it was too risky. Your monthly fee during the busy season was their insurance premium.

Bottom Line: You can position short-term or even long-term contracts as insurance policies if you understand the potential dollar gains and losses your client faces without you, and the likelihood you think those outcomes may occur.

Conclusion

It’s vitally important as consultants and agency folks that we be able to articulate our value in a way that resonates with key client stakeholders such as C-level and finance execs. Evermore our client POCs are under increasing pressure to translate digital marketing tactics, strategies, and wins into dollar terms that can move business KPIs such as Gross Profit. Key to our success then is making it clear how we can drive revenue, reduce costs, avoid future cost and provide insurance. These are four ways to increase client value and we don’t always take credit for all four.

Lastly, don’t forget that sometimes the value we create can last for more than one SOW duration. For example, if you are providing services to support a product launch, ask your client if there is an internal planning horizon over which the success of the initiative is determined.

If your client has a three-year project budget or P&L established, then articulate your ability to drive value over all three years.

If you’re providing SEO services, your activity can not only have an immediate, or Year 1, impact, but the benefits may also accrue in Year 2 and maybe even Year 3.

Don’t leave your complete, multi-year value (and ROI) story on the table for others to claim! Remember that somewhere at your client is a Director or VP of Finance who might better appreciate the work you do if you spoke her language when describing your impacts. And remember you when it’s time to renew your contract 🙂

How have you mapped your work to client value? I’d love to hear about it – send me an email!

Source: www.seerinteractive.com, originally published on 2023-02-03 23:15:00

Connect with B2 Web Studios

Get B2 news, tips and the latest trends on web, mobile and digital marketing

- Appleton/Green Bay (HQ): (920) 358-0305

- Las Vegas, NV (Satellite): (702) 659-7809

- Email Us: [email protected]

© Copyright 2002 – 2022 B2 Web Studios, a division of B2 Computing LLC. All rights reserved. All logos trademarks of their respective owners. Privacy Policy

![How to Successfully Use Social Media: A Small Business Guide for Beginners [Infographic]](https://b2webstudios.com/storage/2023/02/How-to-Successfully-Use-Social-Media-A-Small-Business-Guide-85x70.jpg)

![How to Successfully Use Social Media: A Small Business Guide for Beginners [Infographic]](https://b2webstudios.com/storage/2023/02/How-to-Successfully-Use-Social-Media-A-Small-Business-Guide-300x169.jpg)

Recent Comments