31 Jul

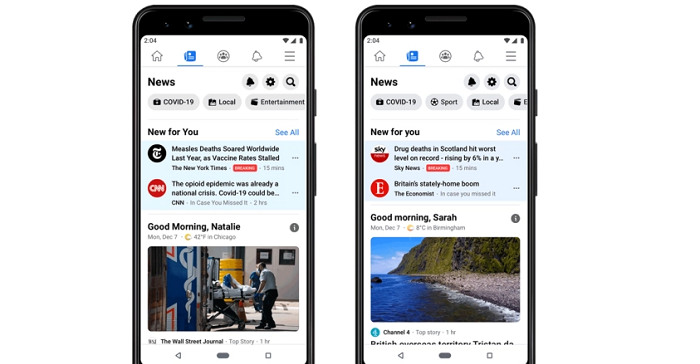

Amid rising costs, and an increasingly uncertain ad market, Meta has begun informing US news publishers that it will not renew exclusive content deals with them, as it shifts away from its dedicated News Tab strategy.

As reported by The Wall Street Journal:

“Meta has begun telling publishers in the US that it won’t renew contracts to feature their content in its Facebook News tab, according to people familiar with the matter […] Meta had signed up a host of publishers in recent years, including deals worth tens of millions of dollars with news organizations such as The Wall Street Journal, the New York Times and the Washington Post.”

In total, those deals are believed to be worth more than $100 million, with all of that going straight back to news publishers, providing a key lifeline, in many respects, amid the broader ad market downturn.

Now, those publications will have to find new ways to prop up their businesses – though interestingly, Meta will be maintaining payments to news publishers in the UK, France, Germany and Australia, where, at least in some cases, these payments have been enshrined into law as part of deals to secure a level of revenue share with local publishers for the use of their content.

The most high-profile example of this is in Australia, where Meta actually blocked local news outlets entirely at one stage due to a dispute over its obligation to share revenue with them, as outlined in the Australian Government’s new Media Bargaining Code.

Meta’s stance on this was that it should not have to pay ‘for content that the publishers voluntarily place on our platforms and at a price that ignores the financial value we bring publishers.’

And Meta’s right – Australia’s Media Bargaining Code, which powerful local publishers had lobbied for, significantly over-values the benefit that news publishers provide to Meta and its apps.

But eventually, a deal was established, which now means that Meta needs to uphold these payments as part of its ongoing obligations in the region.

Which could make backing out of its News tab entirely a difficult proposition, and Meta has said that its dedicated News content feed will remain, even with this change in funding structure.

But US publishers don’t have the same policy backing as other regions – and you can bet that Meta will also be looking to reduce other elements of funding for news publishers and journalists, which had been a significant focus in recent times (note: Meta’s also pulling support for its Bulletin newsletter platform, which it launched in April last year).

With its massive investment into the metaverse stacking up, the company’s looking to rationalize wherever it can.

Meta lost $2.8 billion on metaverse-aligned investments in the most recent quarter, while the company’s net income is at the lowest level that it’s been for two years.

That’s why Zuck and Co. are implementing various cost-cutting measures, including staff cuts, scaling back of in-app features (like social audio) and the abandoning of secondary projects including its smartwatch experiment and consumer Portal devices.

In some ways, this is uncharted territory for the company, which has thus far only seen growth, and it’ll be interesting to see how it adapts to tougher market conditions, and what that then means for its short-term strategies.

But what we know right now is that anything not directly connected to boosting user engagement, or the metaverse shift, is likely on the chopping block.

How long that lasts, and how far it reaches, will be dependent on broader market trends.

Source: www.socialmediatoday.com, originally published on 2022-07-28 16:00:32

Connect with B2 Web Studios

Get B2 news, tips and the latest trends on web, mobile and digital marketing

- Appleton/Green Bay (HQ): (920) 358-0305

- Las Vegas, NV (Satellite): (702) 659-7809

- Email Us: [email protected]

© Copyright 2002 – 2022 B2 Web Studios, a division of B2 Computing LLC. All rights reserved. All logos trademarks of their respective owners. Privacy Policy

![How to Successfully Use Social Media: A Small Business Guide for Beginners [Infographic]](https://b2webstudios.com/storage/2023/02/How-to-Successfully-Use-Social-Media-A-Small-Business-Guide-85x70.jpg)

![How to Successfully Use Social Media: A Small Business Guide for Beginners [Infographic]](https://b2webstudios.com/storage/2023/02/How-to-Successfully-Use-Social-Media-A-Small-Business-Guide-300x169.jpg)

Recent Comments